Mortgages come in a variety of forms. Finance is the study and management of money investments and other financial instruments.

Pengantar Akuntansi 2 Ch13 Statement Of Cash Flow Cash Flow Cash Flow Statement Small Business Bookkeeping

Ideal properties also include a garage or other storage and a useable yard.

. Types of Mortgages. Investment Banking Interview Questions Category 4. Iii For purposes of paragraph c6i of this section an audit client that is an investment company registered under section 8 of the Investment Company Act of 1940 15 USC.

It is the sum of equity capital reinvestment of earnings other long-term capital and short-term capital as. Technical Questions and Answers. Learn about the basics of public corporate and personal finance.

Put simply to succeed in investment banking interviews you need to put in the time to study accounting finance valuation and MA and LBO. The most common types are 30-year and 15-year fixed-rate mortgages. 12112006 I am little confused about the differences between Investment Banking and Capital Markets Structuring Origination.

Some mortgage terms are as short as five years while others can run. The second category on your investment profile is the ideal terms aka the numbers. When you transfer from investment property then the deemed cost is also fair value at the date of transfer.

Difference between assets carrying amount and its fair value is treated in the same way as revaluations under IAS 16. Would someone please explain the differences between the two. Foreign direct investment Net BoP Current US Per capita.

Derecognition of investment property. For this last category I do not have any magical tips that will get you results in hours instead of weeks or months. Foreign direct investment is net inflows of investment to acquire a lasting management interest 10 percent or more of voting stock in an enterprise operating in an economy other than that of the investor.

Target full market price range is between 120000 to 199000. Clearly then from the firms point of. Ideal properties are on quiet safe streets convenient to schools and shopping.

The derecognition rules when you can remove your investment property from your books in IAS. Difference between i-banking and Capital Markets Structuring Origination Originally Posted. 80a-8 does not include an affiliate of the audit client that is an entity in the same investment company complex as defined in paragraph f14 of this section except for another registered.

By contrast if the firm had raised 40 of financing by selling newly issued bonds that pay bondholders an annual coupon-interest rate of say 10 percent and if the firm faced a profit tax of 46 percent then its annual after-tax cost of debt financing would be only 1-04601040 216 per 40 of debt financing or 54 percent per year.

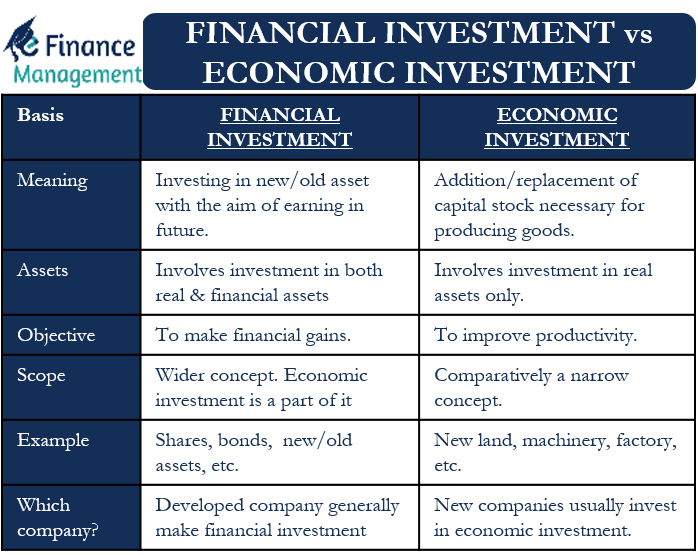

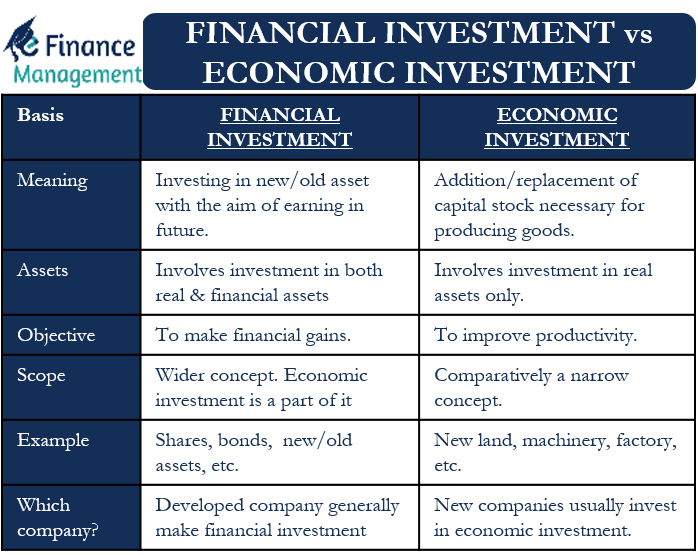

Economic Investment Vs Financial Investment All You Need To Know

Difference Between Investing And Financing Activities With Table Ask Any Difference

Investment Banking Definition Lenn Mayhew Lewis Investment Banking Investing Investment Companies

0 Comments